Happy March and welcome to this year's financial spotlight.

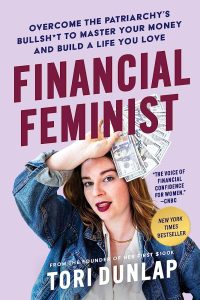

Tori Dunlap is a rising star in business and financial education. The author of Financial Feminist became an author at 28, three years after saving and investing $100,000 by the age of twenty-five. Miss Dunlap runs her own website, herfirst100k.com, opens a new window , and she has one of the highest listened-to podcasts available on Apple and Spotify. Dunlap's podcast has been as high as the #1 Business podcast on both previously mentioned platforms, and she remains widely listened to, including via TikTok and Instagram. She was also a recent honore for the Forbes "30 Under 30" list.

Miss Dunlap began her financial journey straight out of college in 2016, with a well-paying, well-qualified job that she absolutely hated. More than the job itself, Dunlap hated what she endured as an employee, and what she has seen, and continues to see happen, particularly among women. In truth, much of what Dunlap ultimately has to say is not just for the ladies, but can easily be applied to people of differing ethnicities, education, background, and especially to those among the LGBTQIA+ community. Dunlap is a warrior, and her enemy is financial inequality.

Unlike many financial advice books, there is very little math or budgeting to be found. Financial Feminist reads mostly as prose, recounting Dunlap's experiences, and the similar misadventures of other contributors she has met along the way. If you were worried about being bombarded by math and websites, be at ease, though Miss Dunlap does occasionally remind the reader that she has a website and a blog; it's just not nearly so bad as the likes of certain other financial writers, such as Mr. Ramsey or Ms. Orman.

I found the read to be empowering AND educational, and I expect other readers might as well. In much the same tradition as Ms. Orman, Dunlap speaks finance in realistic terms, for a more every day audience. And when we say everyday, we really mean it this time, because Dunlap largely addresses the financial hardships particularly faced by women, people of color, and the LGBTQIA+ community, who regularly face greater difficulty financially, for a variety of reasons. The advice speaks on a more personal level, that leaves out the admonishment often aimed at readers who simply did not know what kinds of financial decisions they should be making.

The usual advice of how to improve financially is at play here:

- Build an emergency fund

- Pay off debt, starting with the more costly debts with higher interest

- Invest in broad index funds

- Responsibly leverage resources such as credit cards like you would coupons, without building more debt

What numbers should you have? It doesn't matter; Dunlap recognizes that everyone's story and experience is different, and the circumstances dictate what each person needs. Though, when she does choose to use numbers for comparing wages and credit card payments and debt, Miss Dunlap falls a bit short by using her own, frankly high, numbers. It's her experience though, and the advice is sound, so readers can rest assured that with some tweaking involving their own numbers, the pathway to your own 'first 100k' is a sound one.

Looking for something else? As always, the St. Tammany Parish Library is happy to offer free use of our online catalog, opens a new window for more information on this and other topics.

Also feel free to visit the STPL Bloggers, opens a new window. We're always writing about a variety of topics you may find interest.

And as always, we appreciate your support.

Happy reading!

Add a comment to: Non-fiction Spotlight: Financial Feminist